Table of Content

Once you’ve submitted your application, one of our friendly banking specialists will be in touch from 9 January 2023 to answer any questions and guide you through the next steps. We'll keep you informed and up to date throughout the process. And if you need any help along the way, our home loan specialists are available to answer any questions. With a straightforward application process and fast turnaround times, you'll get a timely response on the status of your loan.

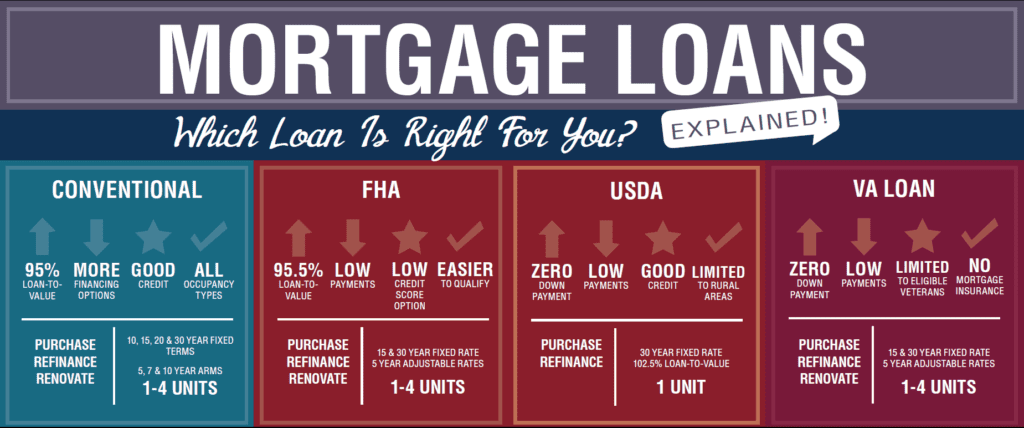

Exceptions to this include, but are not limited to, property type and occupancy status . Minimum down payment for FHA is 3.5%, and VA and Rural Development require 0% down. Very convenient online application and helpful call staff to attend to any issues or questions we had. While pre-approval is not a fully approved loan it can help you narrow your search, negotiate, and make an offer with certainty and confidence. Pre-approval means that a lender has agreed to lend you an amount of money in-principle, but the loan hasn't been proceeded to full or final approval.

Comparing CUA / Great Southern Bank home loans

A minimum of $20,000 must be in the variable portion of this split loan to take advantage of the offset account benefits. Don’t get stung with a high variable rate at the end of your fixed term. With a Macquarie fixed interest rate, you’ll roll off onto a competitive variable rate when your fixed interest rate term ends. Make sure that you compare Great Southern Bank to other lenders before applying as while they do have some great home loans, they aren’t competitive for all deposit sizes, loan sizes or customer types. Great Southern Bank is the largest customer-owned financial institution in Australia so it combines the strength and systems of a major bank with the customer service and value of a credit union.

5 For Interest Only loans, a maximum interest only period of 36 months applies for owner occupier loans and 60 months for investor loans. The interest only period must align with the fixed rate period. On expiry of the interest only period, the loan will revert to the Basic Variable Principal & Interest Owner Occupier or Investor Reference Rate which applies at the time of expiry. Great Southern Bank’s fixed and variable home loans for owner occupiers, investors and builders have no annual or monthly fees and come with some flexibility on loan repayments .

Can I have a fixed rate and an offset account?

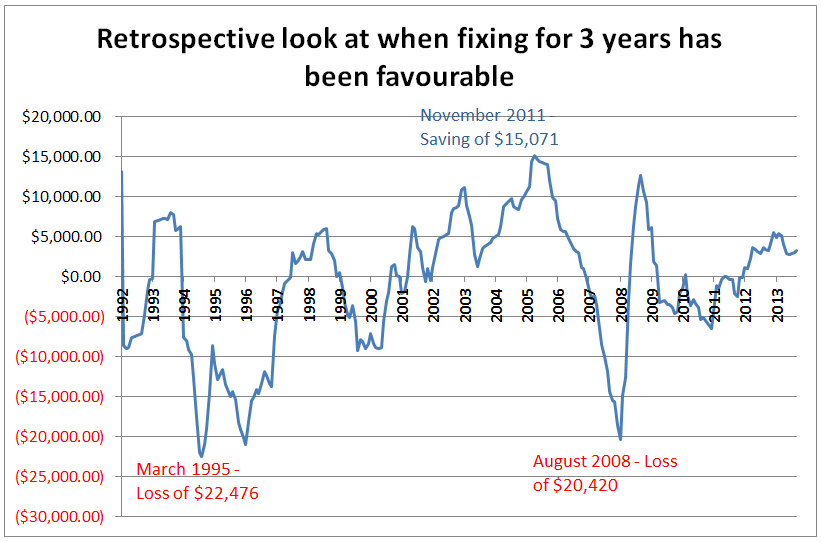

Locking in a fixed rate today could save you money on interest repayments in the future. We see Great Southern Bank as being suitable for someone with one home loan with a large deposit. If you are this type of person then we think CUA is an excellent choice! As mortgage brokers we’re only too aware of the games played by the major banks to change people’s interest rates after their loan is advanced. You’re far less likely to have this happen to you if your loan is with CUA. 1You can choose to pay Principal and Interest weekly, fortnightly, or monthly.

Lock in a great rate so you know what your repayments will be for up to 5 years. Lock in a Fixed Rate so you can get certainty with fixed repayments. With $0 monthly and $0 annual account fees, you can save thousands over the life of your loan. Our Fixed Rate Home Loan gives you certainty of knowing exactly what your regular repayments will be for a period of one, two or three years. Featuring our lowest fixed rate, the Ultimate Home Loan Package locks in an interest rate for up to three years and bundles together a range of discounts and benefits.

Meet Our Mortgage Team

11 Fixed Rate Lock is available to new applications from 27 April 2022. A non-refundable Fixed Rate Lock Fee applies to each fixed rate loan that is locked, refer to our Lending Schedule of Fees for the fee amount. On expiry of the fixed rate period, the loan reverts to the Basic Variable Reference Rate relevant to your loan purpose and repayment type which applies at the time of expiry. 7 Fixed Rate Lock is available to new applications from 27 April 2022. Rate lock allows you to lock in the interest rates from when we receive your completed rate lock form and will end 90 days after we process your request.

Because it is customer-owned, the profits are returned to customers in the form of lower rates and fees. Published interest rates are inclusive of any discounts off the respective Reference Rates. Interest rates and discounts vary based on the loan purpose , repayment type and Loan to Value Ratio .

Variable rate loans come with unlimited extra payments without a fee. Open up to 10 offset accounts per variable loan account if you have an individual or joint borrower home loan. Company and trust borrowers can open up to 4 offset accounts which must be opened at application. Offset accounts cannot be linked to fixed rate loan accounts. For split loans, with a fixed and variable rate portion, the variable rate loan account must have a minimum limit of $20,000 to qualify for an offset account. 10 On expiry of the fixed rate period, the loan reverts to the Basic Variable Reference Rate relevant to your loan purpose and repayment type which applies at the time of expiry.

You can apply for pre-approval even before you’ve found your property and be one step closer to a successful home purchase. RRSP loans offered by CUA provide an opportunity for members to maximize their RRSP contribution. We offer mortgage options to fit every need and even have options such as no down payment. Saving for a down payment to purchase a home can sometimes feel like an impossible financial goal to achieve. If this takes place, home loan rates in Singapore could move above the 4 to 5 per cent range by next year, he said. Mr Chow pointed out that there was a strong correlation between home loan rates in Singapore and the US Federal Reserve rates.

If you wish to apply for a loan, then you need to complete the application form available from our staff. Great Southern Bank have had a range of award winning fixed and variable rate home loans that suit most home buyers or investors. A fixed home loan has interest rates that remain unchanged throughout the lock-in period. A floating loan, on the other hand, varies throughout the life of the loan, depending on the economy and market conditions. Divide your loan into multiple accounts to take advantage of the benefits of both fixed and variable interest rates. Offset home loans cannot be fully fixed, the loan will be split into fixed and variable portions.

To view the Target Market Determination for this product, please click here. Rates current as at 15 December 2022 and subject to change. If you are applying with another person, both applicants need to be present. CUA knows that homes come in all different shapes and sizes.

If you are unable to apply online, don’t worry, one of our friendly home loan specialists will contact you to kick-start your application. Simply check if you qualify online and begin the application process. If you’re looking for a mortgage that makes payments more predictable and budgeting easier, a fixed-rate mortgage could be the right choice for you. In Singapore, a floating rate home loan is usually pegged to the Singapore Interbank Offered Rate , a Fixed Deposit Based Rate or the Singapore Overnight Rate Average .

Get access to accurate information, tools & support to help you reach your goal. We moved a loan from another bank we were disappointed in and I couldn't believe just how simple it was. Getting a home loan or home equity line of credit with Credit Union of America is convenient and easy. We have local underwriters and offer flexible programs to meet your needs.